rate

answered

studied

The Series 9 exam is a co-requisite with the Series 10 exam, meaning that you must pass both exams to get your General Securities Sales Supervisor registration. In addition to passing the Series 9 and Series 10 exams, you will also need to have previously passed the FINRA Securities Industry Essentials (SIE) exam, and the General Securities Representative Exam (Series 7) exam.

Series 9 and 10 candidates must be associated with and sponsored by a FINRA member firm or other applicable self-regulatory organization (SRO) member firm to be eligible to sit for the exam.

The Series 9 exam and Series 10 exams - known together as the General Securities Sales Supervisor Qualification Exams - cover the laws, regulations, ethics, strategies, and various topics important to the role of an entry-level principal performing the role of a general securities sales supervisor. The Series 9 is very focused on options, specifically options strategies; supervising options sales practices, trade activities, accounts, and communications; rules & regulations with a heavy emphasis on options; and personnel management. The Series 10 covers many of the same topics but in general, and not specifically focused on options.

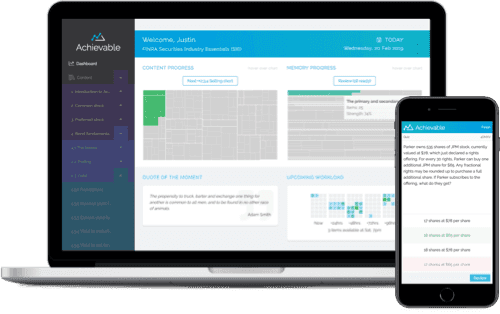

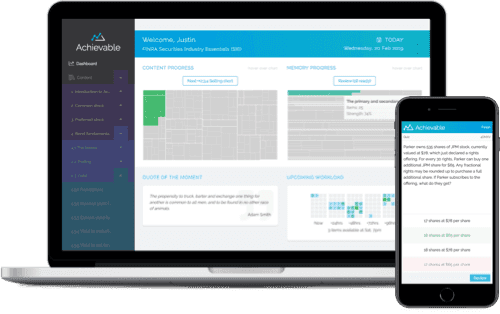

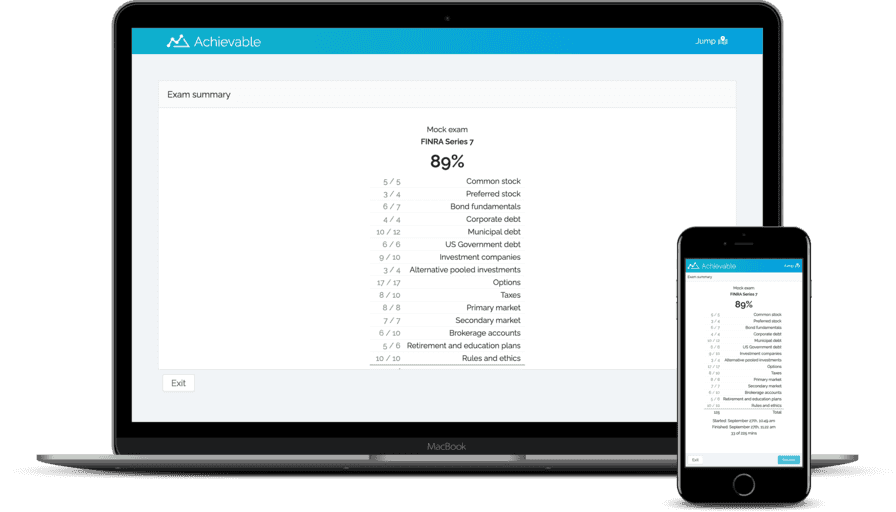

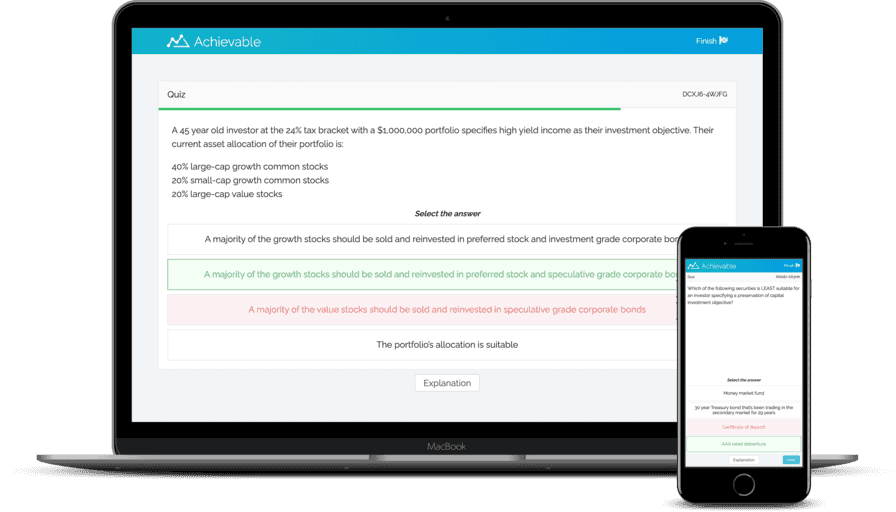

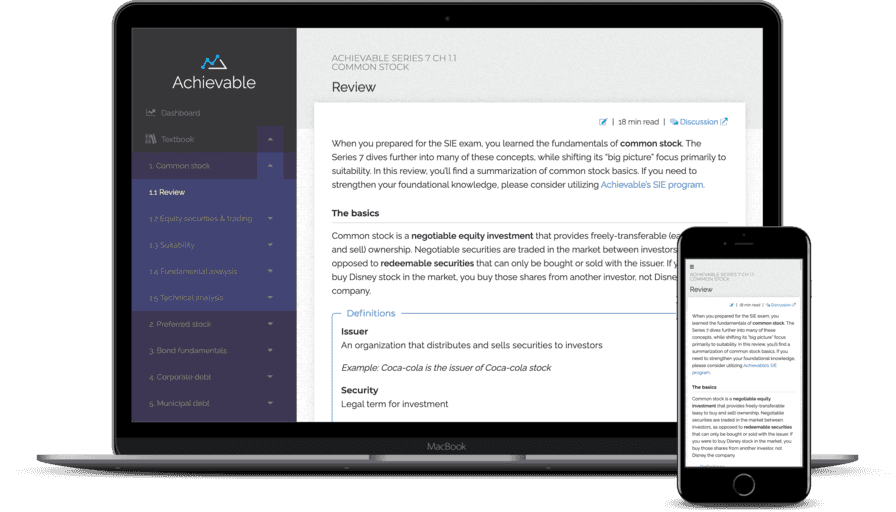

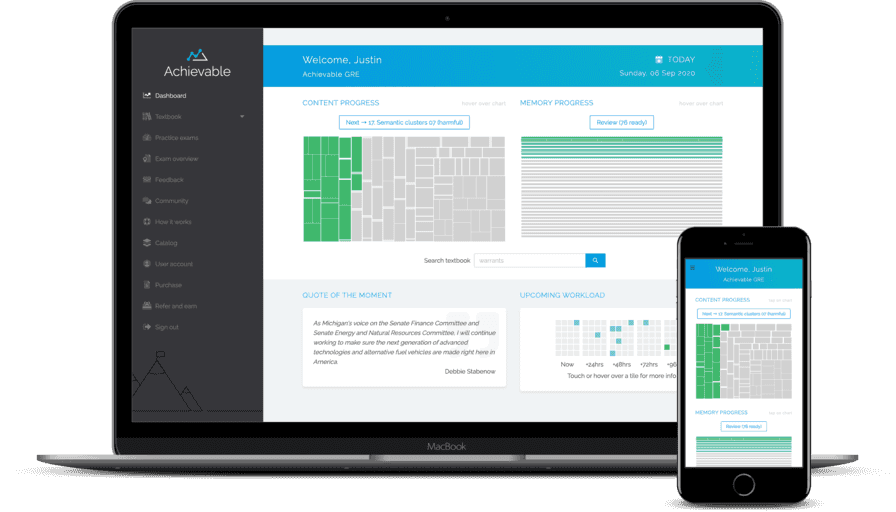

When you buy the Achievable Series 9 course, you'll get access to our extensive question bank of 2,000+ chapter quizzes and 18+ practice exams.

Our practice exams are carefully constructed to match what you'll see on the actual Series 9, based on over a decade of training experience. Furthermore, our math-based questions are templatized so that you see different numbers each time, ensuring that you're learning the underlying concept and not just the right answer.

The General Securities Sales Supervisor Exams (Series 9 and 10) are what FINRA calls “limited principal exams.” This means that they qualify you to supervise sales activities of a broker-dealer, including corporate securities (equity and debt), investment company products, variable contracts, municipal securities, options, government securities, and direct participation programs (DPPs). But only the sales activities. The Series 9 and 10 licenses do not qualify you to supervise other areas of the securities business, such as underwriting, trading, or compliance.

The Series 24 exam, on the other hand, gives you much more breadth in what you can supervise as far as firm functions, but it is more limited in the types of products you can supervise (specifically, you cannot supervise municipal securities or options activities with the Series 24). The Series 24 exam is also considered more difficult than the Series 9 and 10 exams.

No, you can choose which exam to take first.

No. You are welcome to do so if you wish, but you do not have to and can take the exams on separate days. This is generally recommended to reduce the burden of studying and test taking. The Series 10 in particular is very long at 4 hours, and can cause fatigue. You must pass both exams within two years or you have to restart, so make sure you leave plenty of time to pass the other exam.

The Series 9 exam and Series 10 exams are known together as the General Securities Sales Supervisor Qualification Exams. When you pass these exams and gain your General Securities Sales Supervisor registration, you will be managing the activities of other registered representatives - typically Series 7 licensees. Therefore, these exams cover the functions of a general securities sales supervisor that are most important for maintaining lawful conduct among you and your subordinates, including: the customer account creation, approval, and handling; sales and sales supervisory personnel training; trading and options activities; and the proper maintenance of records.

The Series 9 is all about options, and covers options strategies themselves, how to supervise the implementation of these strategies, suitability for different types of options trades for customer accounts, options rules and regulations, and training and personnel management related to options trading.

The Series 9 exam is hosted by FINRA and costs $130 to register. Participants have 1 hour 30 minutes to answer 55 multiple-choice questions. The passing score is 70% (39/55).

The Series 9 exam has two prerequisites: you must have an active and in-good-standing FINRA Securities Industry Essentials (SIE) license and General Securities Representative (Series 7) license. Additionally, in order to earn your General Securities Sales Supervisor registration, you must also pass the Series 10 exam, which is considered part of an exam pair with the Series 9 by FINRA.

You must be sponsored by a FINRA member firm in order to register for and take the Series 9 exam. You will need to work with your company's compliance department to fill out and submit a Form U4 in order to register for the exam.

The Series 9 exam is administered via computer. A tutorial on how to take the exam is provided prior to taking the exam.

Each candidate's exam includes 5 additional, unidentified pretest items that do not contribute toward the candidate's score. The pretest items are randomly distributed throughout the exam. Therefore, each candidate's exam consists of a total of 60 items (55 scored and 5 unscored).

There is no penalty for guessing. Therefore, candidates should attempt to answer all items.

Candidates will be allowed 90 minutes to complete the Series 9 exam.

Candidates are not permitted to bring reference materials to their testing session. Severe penalties are imposed on candidates who cheat or attempt to cheat on FINRA-administered exams.

All candidate test scores are placed on a common scale using a statistical adjustment process known as equating. Equating scores to a common scale accounts for the slight variations in difficulty that may exist among the different sets of exam items that candidates receive. This allows for a fair comparison of scores and ensures that every candidate is held to the same passing standard regardless of which set of exam items they received.

The creation and management of customer options accounts by your sales subordinates. Topics include types of customers and customer accounts; reviewing customer options trading activities to determine if they meet applicable standards; margin account handling; CBOE, FINRA, and NYSE rules related to options accounts and their requirements; and other rules and regulations.

Supervising options trading activities and handling any issues. Topics include reviewing and handling customer complaints; overseeing the correction of options trading errors; reviewing daily trading activity for completeness and accuracy; and managing general options trading operations.

Supervising communications to customers and the public related to options trading. Topics include options retail communication (such as social media or public appearances); reviewing options correspondence from your subordinates to customers; and reviewing institutional options communications.

Personnel management related to your team and options, including training. Topics include knowing the terms, definitions, rules, regulations, economics, and taxation of sophisticated options products and strategies, and training your team on them.

Introduction to the Series 9 exam.

The fundamentals of options contracts, including their issuance, structure, and specifications. Basic and advanced options strategies are covered, including single-leg, hedging, income, synthetic, ratio, straddles, combinations, spreads, and iron condors. Non-equity options such as index, VIX, foreign currency, and yield-based options are also covered. Additionally, this chapter discusses the suitability of the various strategies.

The process of opening brokerage cash and margin accounts, particularly focusing on accounts eligible for options trading. Customer and intra-industry disputes involving arbitration and litigation claims are also discussed.

The various rules and regulations that apply to the securities markets and participants, particularly related to options activity. Topics such as registration, reporting, market dynamics, contract adjustments, taxation, public communications, fiduciary standards, anti-money laundering, and record retention are covered.

Series 9 resources